How to Open Demat Account at Angel Broking Online?: Angel broking is one of the leading full-service brokers in India which offer flat brokerage charge to its clients. It provides fast, modern, and easy to use trading platforms as well as expert advisory services to its customer base. In this post, we’ll discuss the exact steps to open demat account at Angel Broking online.

Angel Broking Introduction

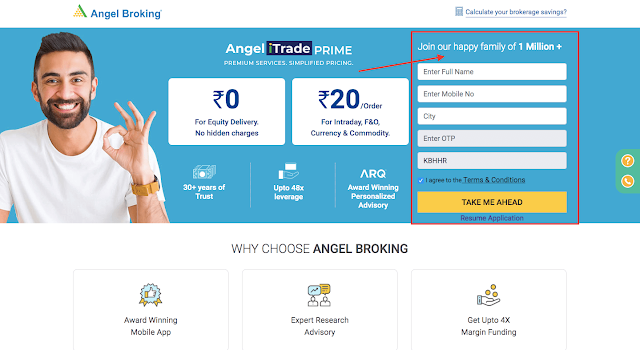

Incorporated in 1987, Angel broking is a big brand having +30 Years of experience in the broking world and +1 million happy customers. They have a presence in over 1800+ cities in India and a strong network of 8500+ sub-brokers. Angel Broking offers the trading facility in Equity, F&O, Commodities, and currency across BSE, NSE, NCDEX & MCX.

In the past, Angel Broking worked as a full-service broker and offered a percentage based brokerage charge to its clients for over two decades. However, they recently changed their business model (Nov 2019) from percentage brokerage to flat rates to compete with rapidly growing discount brokers like Zerodha, 5Paisa, Upstox, etc.

Documents required to open a demat account at Angel Broking

In order to open your demat account at Angel Broking, you’ll require the following documents. It is recommended to keep the scanned copies of these documents:

- Aadhar Card

- Pan Card

- Bank proof (Cancelled cheque/Account Statement)

Here, basically you have to provide the bank proof for the bank that you want to link with your demat account. It can be any private or public national bank in India.

If you want to open your account online, it is required that your phone number should be linked with your Aadhar card. This is because you’ll be asked to complete online ‘eSign’ and for this step, you’ll receive an OTP on your registered phone number with Aadhar card. Account opening charges at Angel Broking FREE

Short Answer to Open Your Angel Broking Demat Account

First of all, let me give you a short answer on how to open your demat account at Angel broking, before my step-by-step explanation.On this page, the first step is to signup by entering your full name, your city, mobile number, and verifying the OTP. Then, you’ll be required to enter your PAN, bank account, Aadhar verification, and personal details to continue with the signup. Finally, you’ll need to eSign and online self-verification to complete the procedure.

Moreover, you’ll be assigned an angel broking executive once you sign up on the first step. Their details will be sent to you via message. He/She will help you out in the entire account opening process. If you face any difficulties while opening an account online, you can directly reach them out.

Detailed Step-by-step procedure to open your Angel Broking demat account online

Step 1: Go to the Angel Broking account opening page

Step 2: Enter your Full Name, City, and Mobile Number on the Account opening page. Here, you’ll receive an OTP to verify your phone number.

Step 3: On the next page, you’ll need to enter a few other important details. Here, you’ve to provide your date of birth, PAN Number, email id, Bank account number, and IFSC code. You do not need to pay any account opening charges as they are waived.

Step 4: Next, you have to complete your KYC verification. You will be provided three options: 1) Share offline aadhar, 2) Share via DigiLocker 3) Enter details manually. In this post, we’ll discuss the first step where you can share your aadhar via Uidai. Nevertheless, sharing aadhar via DigiLocker is also a very simple process.

While verifying Aadhar via Uidai, first you’ve to ‘Download aadhar details’ by visiting the Uidai website. You can download the ZIP file by clicking on the link on that page. Next, you’ve to upload aadhar details via the same ZIP file here.

Step 5: In this step, you’ve to upload documents and enter some other personal details.

Here, you’ve to provide your annual income, occupation, father, and mother’s name, etc. After that, you’ve to upload your PAN card and bank statement on the next page.

After entering details and uploading documents, click on ‘Continue’.

Step 6: Next is the eSign process which is very simple. Here, you’ve to enter your 12 digit Aadhar card number. After that, you’ll receive an OTP on your registered phone number with Aadhar. Enter the OTP on this page and click on ‘Submit’.

Step 7: The second last step is ‘In-person Verification (IPV)’. Here, you have to make a small video of your face and upload the video file to complete the IPV or self-verification. You can make a video using your phone or laptop. IPV is necessary during the online account opening. After successfully uploading the video, you’ll get a success message displaying ‘Thank you, we have received your IPV’.

Step 8: The final step is to submit the Power of Attorney (POA) form. This POA submission step is required by any broker with whom you open your demat account in India.

In this step, you’ve to download the POA form, physically sign it and courier or speed post this form to the Angel broking head office. Else, you can also ask the angel broking executive to come to your address and collect the signed POA form.

This is the complete process to open your FREE demat account at Angel Broking.

Comments

Post a Comment